TRUF.NETWORK: Solving the Prediction Market Trilemma

TRUF.NETWORK's new protocols solve the Prediction Market Trilemma by achieving unparalleled Data Availability, Liquidity Portability, and Regulatory Clarity, heralding a new era for on-chain prediction markets.

Prediction Markets Arrive On TRUF.NETWORK

This year, TRUF.NETWORK will be debuting sweeping additions to the protocols running on our TRUF nodes. In particular, as of writing, we are in the final phases of end-to-end deployment and testing of a new suite of protocols that will enable fully on-chain prediction markets with market rules and interfaces that feel familiar, yet offer a level of efficiency, security, and transparency unmatched even by the most well known players in the prediction market space. Upon debut, it will be Truflation that is the first to leverage the new TRUF.NETWORK to launch a consumer-facing prediction market. That initial launch will be followed by a string of launches, of both new and established prediction markets, that will all leverage TRUF.NETWORK infrastructure and data to supercharge and scale their offerings.

The Prediction Market Trilemma

The founders and staff at Laguna, the parent organization of both Truflation and TRUF.NETWORK, have deep ties and foundations within the blockchain industry. TRUF.NETWORK was born from a desire to provide Truflation’s industry-leading economic data feeds in a format and medium that would be of maximum value not just to consumers in traditional finance, but could be used to build innovative and powerful data-driven products in the Web3 space as well. Our desire drove us to create a SQL-based distributed ledger network, with standardized data attestation that could be used as oracles within the context of smart contracts, while implementing a system of economic incentives for data providers that provides “accuracy through competition.” Ultimately, TRUF.NETWORK, as it exists today, provides an extreme level of “data availability” - standardized queries, cryptographically provable data attestations, distribution and redundancy with permissionless access - at every level of analysis.

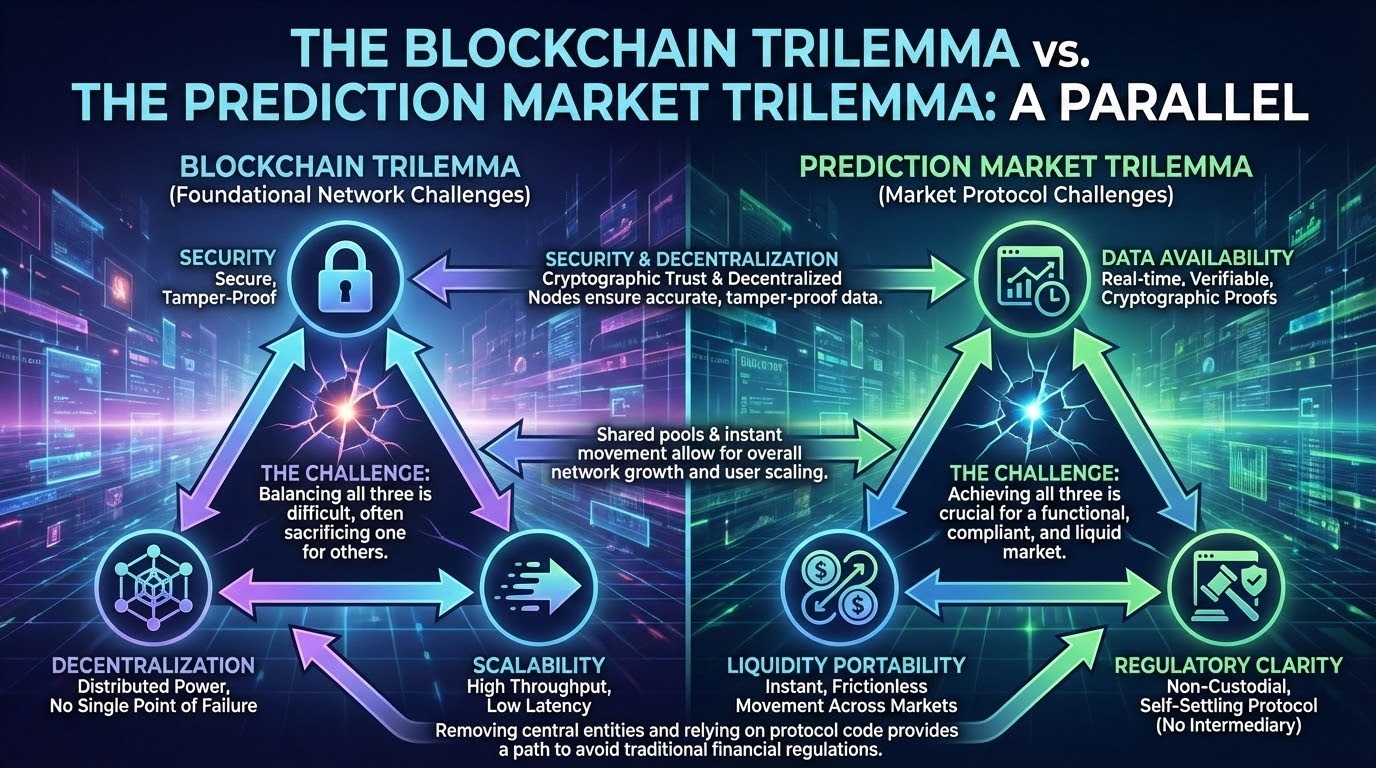

As we watched the explosion of prediction markets, and saw how major, early entrants, such as Polymarket, leveraged blockchain technology, it became immediately clear that TRUF.NETWORK solved data availability would solve data availability problems for Web3 prediction markets. But data availability isn’t the only problem the emerging prediction market space is facing. We saw that the so-called “Blockchain Trilemma” - coined by Vitalik Buterin and representing the need for decentralized networks to balance security, scalability, and decentralization - could be being mapped onto prediction markets. We have coined this phenomenon the “Prediction Market Trilemma,” a need for prediction markets to balance data availability, liquidity portability, and regulatory clarity. Our new envisioning and implementation of TRUF.NETWORK’s prediction market protocols solves the Prediction Market Trilemma.

Data Availability

Anyone with access to a TRUF.NETWORK node, including via the Trufscan explorer, has real-time access to all of our data in a standardized format. Our SDKs return query results of that data that are easy to read by both humans and machines. Those users who are running their own nodes, locally, have root-level access to the PostgreSQL database that powers TRUF.NETWORK. Not only can that user run any SELECT query they choose, they can even enable our provided Model Context Protocol (MCP) server and let their favorite LLM (such as Claude or Copilot) do the queries for them, while they communicate with the AI model using natural language prompts. In addition, should a user want to use a query to settle a smart contract transaction on other networks, like Ethereum, a user can broadcast a special transaction requesting TRUF.NETWORK validators to give an attestation, including a smart-contract-compatible cryptographic signature, to serve the function of an off-chain oracle.

Combine these technical features with the fact that TRUF.NETWORK participants, including Truflation, are providing an ever-increasing collection of over 200,000 real-time data feeds, and it is easy to see that TRUF.NETWORK has data availability well in hand.

Liquidity Portability

It is not enough to make data highly available. Markets need liquidity. Unfortunately, the pattern that has emerged in the prediction markets space is that each new entrant is building their own infrastructure, their own walled garden. This emergent phenomenon mirrors the growth of centralized cryptocurrency exchanges. This means additional friction for traders wanting to operate across the maximum number of platforms. TRUF.NETWORK’s SQL-based architecture gives us capabilities that other blockchain networks simply don’t have. It became apparent to us that SQL was an ideal foundation for building order books with the kind of structure and rules already used by major players like Polymarket and Kalshi. Our data attestation capabilities meant that prediction market order books, using any data on TRUF.NETWORK, could be securely and instantly settled. More importantly, network participants can instantly and securely move liquidity between markets that are live on the network. This means that any prediction market that builds on top of TRUF.NETWORK has an existing pool of liquidity to power their order books from day one.

Regulatory Clarity

The pursuit of regulatory clarity remains the third, and perhaps most difficult, pillar of the Prediction Market Trilemma. Prediction markets operating in established financial jurisdictions, like the United States, have run into significant regulatory headwinds, largely because they operate under traditional, centralized structures. Platforms such as Kalshi have attempted to navigate this environment by seeking designation and oversight as Designated Contract Markets (DCMs) under the Commodity Futures Trading Commission (CFTC), a path fraught with high compliance costs and limitations on the types of markets they can offer. The core issue is that centralized prediction markets often mirror the functionality of financial derivatives, placing them squarely within the scope of existing securities and commodities regulations, even if the underlying “asset” is simply an event outcome.

The only sustainable path toward avoiding an unmanageable global regulatory burden is for prediction markets to be entirely non-custodial and blockchain-based. By removing the central intermediary that holds user funds, these markets eliminate the most critical regulatory touchpoints, particularly those related to Know Your Customer (KYC), Anti-Money Laundering (AML), and customer asset segregation.

Recently passed US legislation, such as the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) and concepts encapsulated in proposed US legislation such as Clarity Act (as it pertains to decentralized digital assets), provide a potential roadmap. These frameworks often recognize that when a protocol facilitates self-custody and is truly decentralized, it lacks a central party capable of controlling the market or mismanaging customer funds. A fully on-chain, non-custodial prediction market is designed to be self-settling and self-executing based on cryptographic proofs (like TRUF.NETWORK’s data attestations), meaning it falls outside the traditional definition of a financial institution or money transmitter. By leveraging the non-custodial nature of decentralized “SQL smart contracts,” TRUF.NETWORK enables prediction markets to operate globally, securely, and transparently, dramatically lowering the regulatory surface area and offering a pathway to true global regulatory clarity.

Prediction Markets on TRUF.NETWORK

TRUF.NETWORK’s innovative new architecture directly addresses the three core challenges of the Prediction Market Trilemma: Data Availability, Liquidity Portability, and Regulatory Clarity. Our SQL-based distributed ledger and standardized data attestation system ensure unparalleled data availability, offering over 200,000 real-time feeds accessible on-chain and cryptographically verifiable for settlement. By building prediction market order books directly on this SQL foundation, we achieve true liquidity portability, creating a shared, instantly transferable pool of liquidity that any market utilizing TRUF.NETWORK can tap into from day one, dismantling the “walled garden” effect. Finally, the commitment to a fully on-chain, non-custodial design, leveraging “SQL smart contracts” settled by cryptographic proofs, drastically reduces the regulatory surface area, providing a sustainable path toward global regulatory clarity.

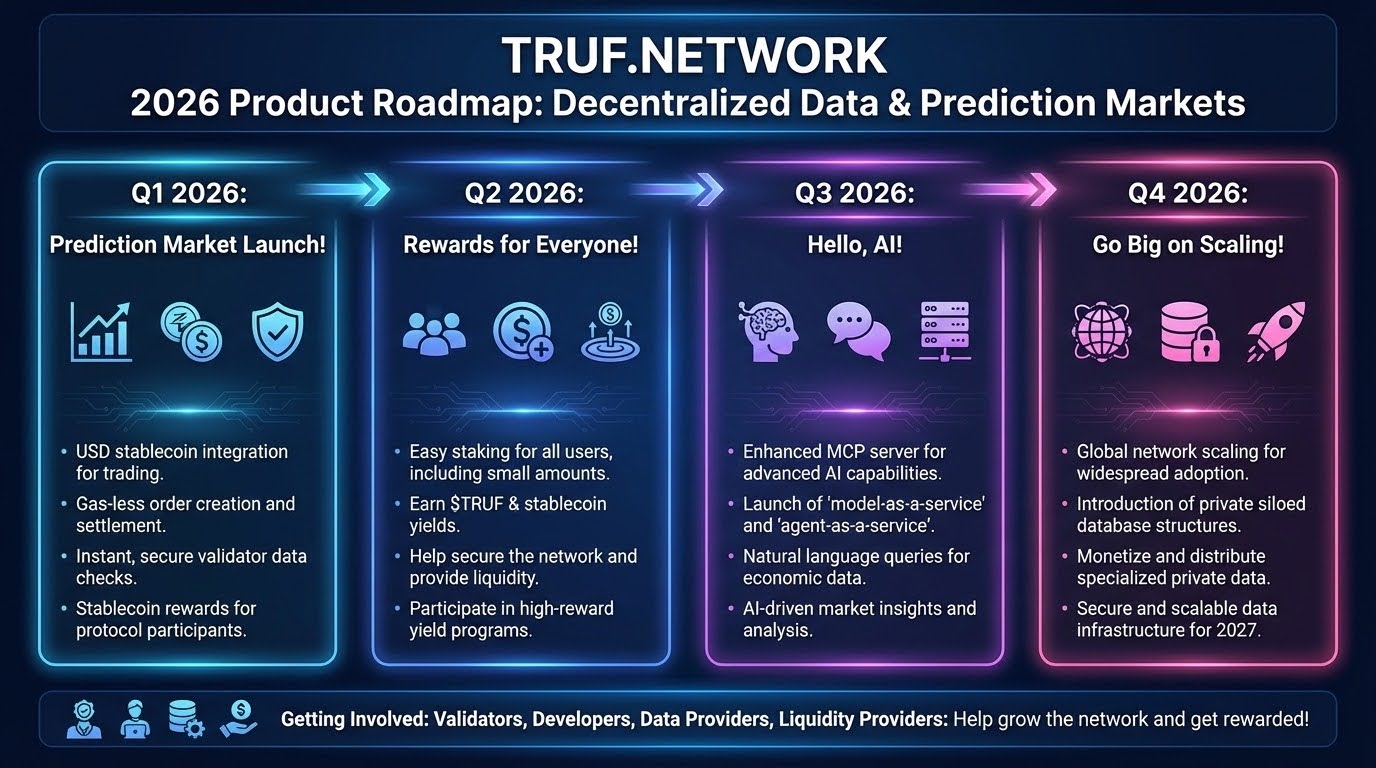

The full deployment of these new protocols on TRUF.NETWORK is imminent, and this infrastructure is poised to revolutionize the prediction market landscape, starting with Truflation’s own consumer market launch. We are excited to transition from discussing the theoretical solutions to demonstrating their practical application. In upcoming posts, we will dive deeper into the technical specifics of the new TRUF.NETWORK protocols, detailing the mechanisms behind our non-custodial order books, the Model Context Protocol (MCP), and the exact process for liquidity portability between prediction markets. Stay tuned for a new era of efficient, secure, and globally accessible decentralized prediction markets.