TRUF.NETWORK: The Non-Custodial Path to Regulatory Clarity

By committing to a fully non-custodial, self-sovereign architecture and utilizing a Digital Commodity token, TRUF.NETWORK provides the regulatory clarity needed to scale prediction markets worldwide.

The burgeoning prediction market space is fundamentally constrained by what we have termed the “Prediction Market Trilemma”: the need to simultaneously balance Data Availability, Liquidity Portability, and Regulatory Clarity. At TRUF.NETWORK, we have already demonstrated our commitment to setting the new standard for data availability and achieving unparalleled liquidity portability. The final, and arguably most critical, pillar is regulatory clarity, which we solve through our architecture’s uncompromising commitment to non-custodial self-sovereignty.

The Foundation of Regulatory Clarity: Full Self-Custody

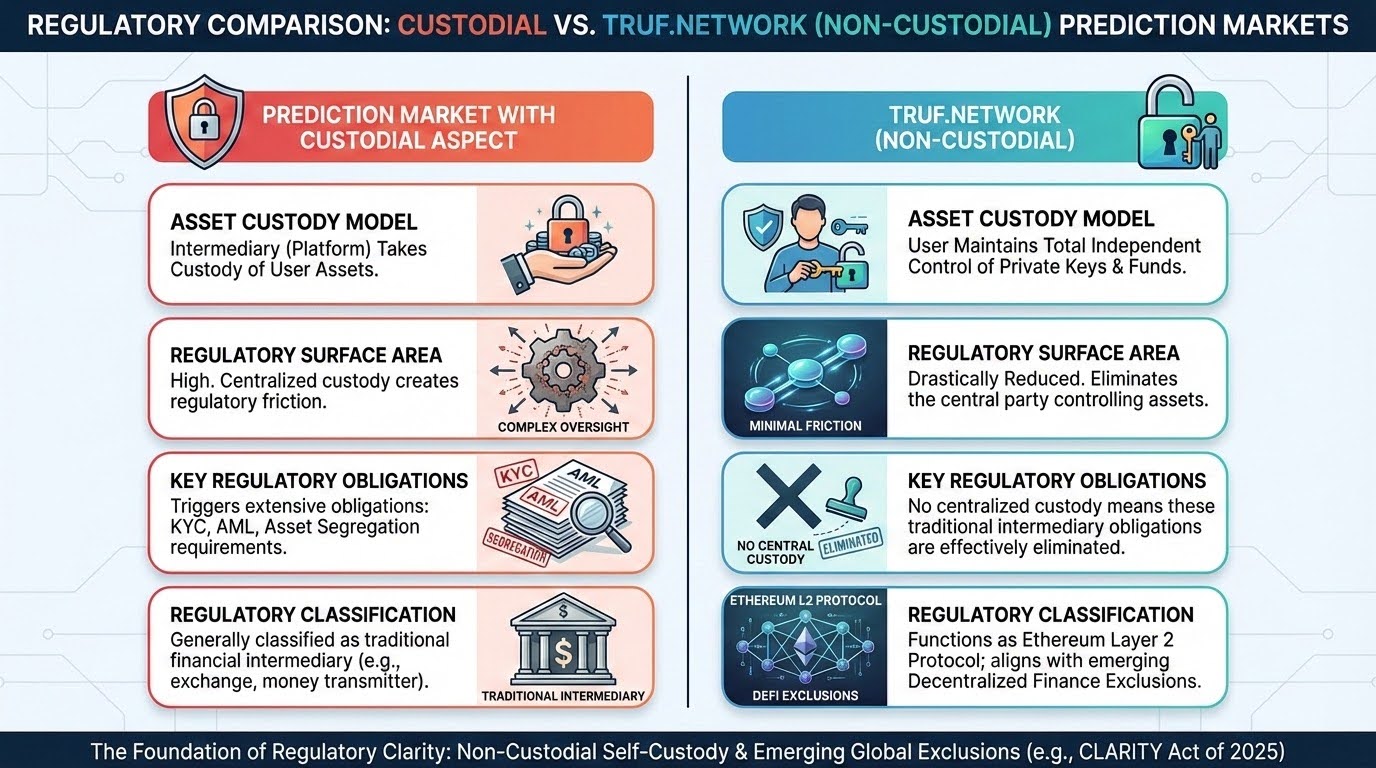

The challenge of regulatory oversight in decentralized finance often stems from the persistence of centralized choke points, places where an intermediary (like a traditional financial institution or a centralized platform) takes custody of user assets. This centralized custody triggers a vast array of regulatory obligations, including Know Your Customer (KYC), Anti-Money Laundering (AML), and customer asset segregation requirements, which are both costly and restrictive.

TRUF.NETWORK is designed to eliminate this regulatory friction by being a fully non-custodial environment.

- Ethereum Layer 2 Protocol: TRUF.NETWORK functions, effectively, as a Layer 2 blockchain protocol for Ethereum Virtual Machine (EVM) blockchains. This positioning leverages the security and decentralization of the underlying EVM network while providing the efficiency and specialization needed for high-frequency prediction markets.

- Total Independent Control: Throughout the entire trading lifecycle, from funding the wallet to placing orders and withdrawing profits, TRUF.NETWORK never takes custody of a trader’s assets. The user is, at all times, in total independent control of their private keys and their funds. All order placement and collateral movement are performed by transactions that require the user’s cryptographic signature alone, adhering to the principle of self-custody.

This non-custodial architecture is the fundamental basis for regulatory clarity. By removing the central party that controls the user’s funds, we drastically reduce the regulatory surface area for prediction markets built on our infrastructure.

Navigating Global Regulatory Regimes

Emerging regulatory frameworks worldwide are beginning to recognize and carve out exemptions for genuinely decentralized, non-custodial protocols. This is the space where TRUF.NETWORK is uniquely positioned.

The path to global clarity is being laid by forward-thinking legislation that seeks to distinguish between centralized intermediaries and decentralized, self-custodial protocols. In the United States, proposed legislation, such as the CLARITY Act of 2025 (H.R. 3633), provides a clear roadmap for this distinction.

The CLARITY Act of 2025 includes a key concept: the Exclusion for Decentralized Finance Activities (see Title III, Sec. 309 and Title IV, Sec. 409 of the bill). The definitions within the Act, particularly for a “Decentralized Finance Trading Protocol,” align precisely with TRUF.NETWORK’s architecture (see Section 1a(16)(E) of the Commodity Exchange Act, as amended by the bill):“The term ‘decentralized finance trading protocol’ means a blockchain system through which multiple participants can execute a financial transaction… without reliance on any other person to maintain control of the digital assets of the user during any part of the financial transaction.”

Since TRUF.NETWORK’s architecture ensures that the user is the only party in control of their digital assets, TRUF.NETWORK users and developers are covered under the decentralized finance exclusions and principles within these emerging global regulatory regimes, most importantly the CLARITY Act. This exclusion provides a sustainable path for prediction markets to operate globally, securely, and transparently.

The TRUF Token as a Digital Commodity

Another critical element of regulatory clarity for the TRUF.NETWORK ecosystem is the classification of the TRUF token. The TRUF token, issued on the Ethereum blockchain, powers the protocol as its native utility and fee-paying asset.

The CLARITY Act of 2025 establishes a framework that classifies most intrinsically linked, non-security-derivative digital assets as a “Digital Commodity.” The definition in the proposed law includes digital assets whose value is derived from or is reasonably expected to be derived from the use of the blockchain system, and specifically those used to:

- Transfer value between participants in the blockchain system.

- Access the activities or services of the blockchain system.

- Pay fees or otherwise verify or validate transactions on the blockchain system.

- Provide incentives to participants in the blockchain system.

The TRUF token is designed explicitly for these utility functions within the TRUF.NETWORK. Consequently, the TRUF token is placed within the same classification as established cryptocurrencies like BTC or ETH, as a digital commodity. This commodity classification offers a high degree of regulatory certainty, insulating the core economic layer of the network from the complexities of securities regulations.

The Future of Compliant Decentralized Markets

TRUF.NETWORK is building infrastructure that is inherently aligned with the principles that the world’s most sophisticated regulatory bodies are seeking to protect: self-custody, transparency, and the elimination of centralized points of failure.

By building on a non-custodial, self-sovereign foundation, and by utilizing a utility token classified as a digital commodity, TRUF.NETWORK provides the necessary regulatory clarity to scale prediction markets worldwide. We eliminate the friction of custodial models and compliance risk, allowing developers and traders to focus entirely on innovation and execution. The future of prediction markets is non-custodial, compliant, and built on TRUF.NETWORK.