Liquidity Portability on TRUF Prediction Markets

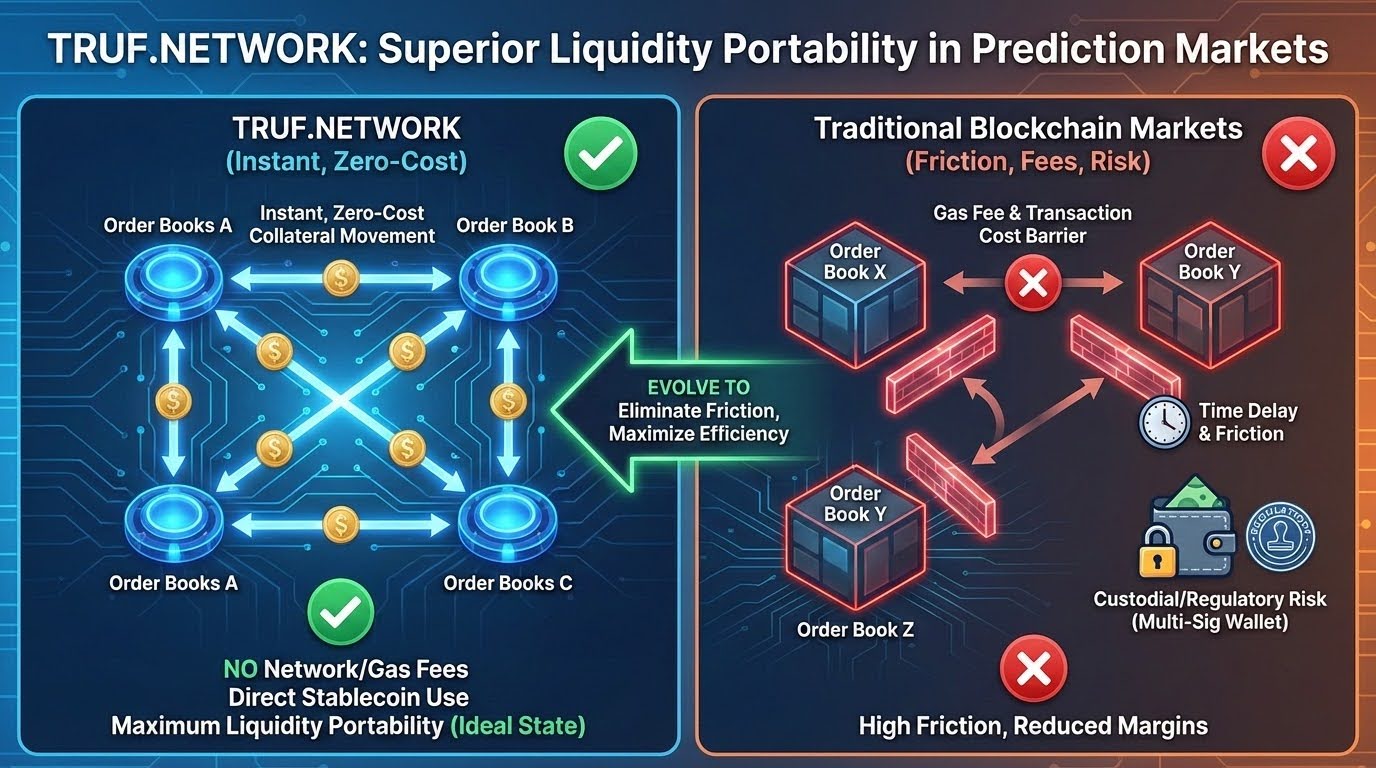

TRUF.NETWORK is revolutionizing prediction markets by offering instant, zero-cost liquidity portability between order books, eliminating the friction and custodial risk found in legacy and first-generation blockchain platforms.

The coming years will see a massive proliferation of prediction markets. While the existence of global, permissionless blockchain-based implementations will necessarily mean that the burgeoning prediction market space will be more accessible to more traders than any previous emergent market space. However, the lack of interoperability standards - something that is taken for granted in legacy financial markets - brings a set of negative tradeoffs to go along with the positive tradeoffs of greater access to the markets themselves. TRUF.NETWORK addresses these tradeoffs on the technical level with our approach to data availability. Of equal importance is the inherent advantage that prediction markets built on TRUF.NETWORK have when it comes to liquidity portability.

Liquidity portability is the inverse of the amount of friction that exists for a trader attempting to move liquid assets - generally stablecoins used as collateral - between order books. The more friction, the lower the measure of liquidity portability. Two markets are considered to have the highest degree of liquidity portability between them if collateral value can be moved, without cost, instantly, between the two markets. In other words, if a trader can move 1000 USDC from market A to market B, instantly, without needing to pay anything in network fees or smart contract commissions, then market A and market B have the ideal amount of liquidity portability. All things being equal, traders will necessarily choose to participate in markets with a high degree of liquidity portability between them, particularly when using those markets as hedges against one another, due to the fact that liquidity portability is positively correlated with trading profit margin.

A Fundamentally Different Approach

TRUF.NETWORK is critical infrastructure for prediction markets. In mere minutes, anyone can, at incredibly low cost, create their own, globally-available order book. At the moment of that order book’s creation, every trader on TRUF.NETWORK can instantly use their collateral within that new order book, without incurring any network/transaction/gas fees to do so. This is fundamentally different even from a scenario where two different order books are built within the same smart contract on a single blockchain, such as Ethereum. In this Ethereum example, someone has to pay the gas fees to execute actions within the smart contract for any move of collateral. Additionally, the transfer is not finalized until it is confirmed in a block, which insufficient gas fee payment can delay. In a completely non-custodial paradigm, the trader is responsible for paying the gas fee. In a scenario where the prediction market creator pays the fee on behalf of the trader, such as with a Polymarket-style multi-signature contract, the prediction market creator has opened themselves up to regulatory scrutiny as a custodian. Different jurisdictions around the world have differing thresholds and this creates significant risk for prediction market creators… risk that is eliminated completely when a prediction market is created on TRUF.NETWORK.

Instantly Move Between Markets

A trader on TRUF.NETWORK can move collateral between different order books with the same degree of liquidity portability with which that trader places and adjusts orders within a single order book. Additionally, since the current state of every prediction market is readily available in the PostgreSQL database that powers TRUF.NETWORK, node operators - anyone can run a node, permissionlessly, for free - can develop powerful, proprietary trading strategies that they can execute on the network with the only cost being the insignificant cost of running a TRUF node. More than that, traders can leverage the MCP server we provide for the TRUF node, attach their favorite LLM, and develop and execute their trading strategies with the assistance of their own AI agents.

Your Funds, Always In Your Control

TRUF.NETWORK is fully non-custodial, at every point in the trading life cycle. At all times, traders (and those providing liquidity to markets to take advantage of our unique and valuable liquidity provider rewards protocol) have total independent control of their funds. All placement of orders and movement of collateral between order books is performed with transactions where, as a trader, it is your cryptographic signature, and your signature alone, no multi-signature wallets, no platform taking custody of your funds, and no added friction. Whether you are moving funds onto the network itself or moving them within the network, they are (and remain) truly your funds, under your full control.

The Future Is Now

In conclusion, liquidity portability is a fundamental metric for evaluating the efficiency and profitability potential of prediction market infrastructure. As the prediction market space continues its inevitable expansion, the infrastructure that offers the highest degree of liquidity portability will attract the highest volume of sophisticated traders, leading to deeper, more reliable markets. TRUF.NETWORK is designed from the ground up to eliminate the friction points that plague legacy and first-generation blockchain prediction market implementations. By offering instant, zero-cost collateral movement between any and all order books built on the network, TRUF.NETWORK provides the ideal environment for traders seeking maximum profit margins and complete, non-custodial control over their assets throughout the entire trading lifecycle. The future of prediction markets is accessible, efficient, and truly portable.. and it’s built on TRUF.NETWORK.