The Crypto Market Cap Index: The One Number That Rules Them All

In a world of fragmented crypto data, Truflation has launched the one number to unite them all.

Day 32 of 100 Days of TRUF

TL;DR

If you’re an investor, trader, analyst, or even a part-time degen who’s tired of crypto market cap numbers that don’t quite add up, meet your new benchmark: the Truflation Crypto Market Cap Index. Built from six of the most trusted crypto data providers, it offers a daily, real-time, weighted reference rate for the total crypto market cap. Transparent. Reliable. Actionable.

The Problem with Crypto Market Cap Data

Crypto is the land of a thousand dashboards - CoinMarketCap, CoinGecko, CryptoRank, Santiment, CoinStats, CoinPaprika… the list grows, and yet none agree.

Each has its quirks:

- Inconsistent listing criteria.

- Data lags and black-box algorithms.

- Varying depth of coverage across assets.

Investors are left asking: What is the actual size of the crypto market?

This fragmentation leaves analysts second-guessing. For developers and portfolio managers, it’s worse—try building an ETF or smart contract logic off inconsistent data. You end up hedging against your own sources.

Enter TRUFCMC: A Unified Benchmark for a Fragmented Industry

The Truflation Crypto Market Cap Index (ticker symbol TRUFCMC) cuts through the noise. It aggregates the top six data providers using a fixed weight formula that reflects their historical accuracy, coverage, and update frequency.

How It Works

Each day at 23:59 UTC, Truflation collects and weights data from:

- CoinGecko

- CoinMarketCap

- CryptoRank

- CoinPaprika

- CoinStats

- Santiment

The result: a daily market cap index value in USD, along with a normalized index score for easier comparison with inflation data and financial benchmarks.

Performance Snapshot

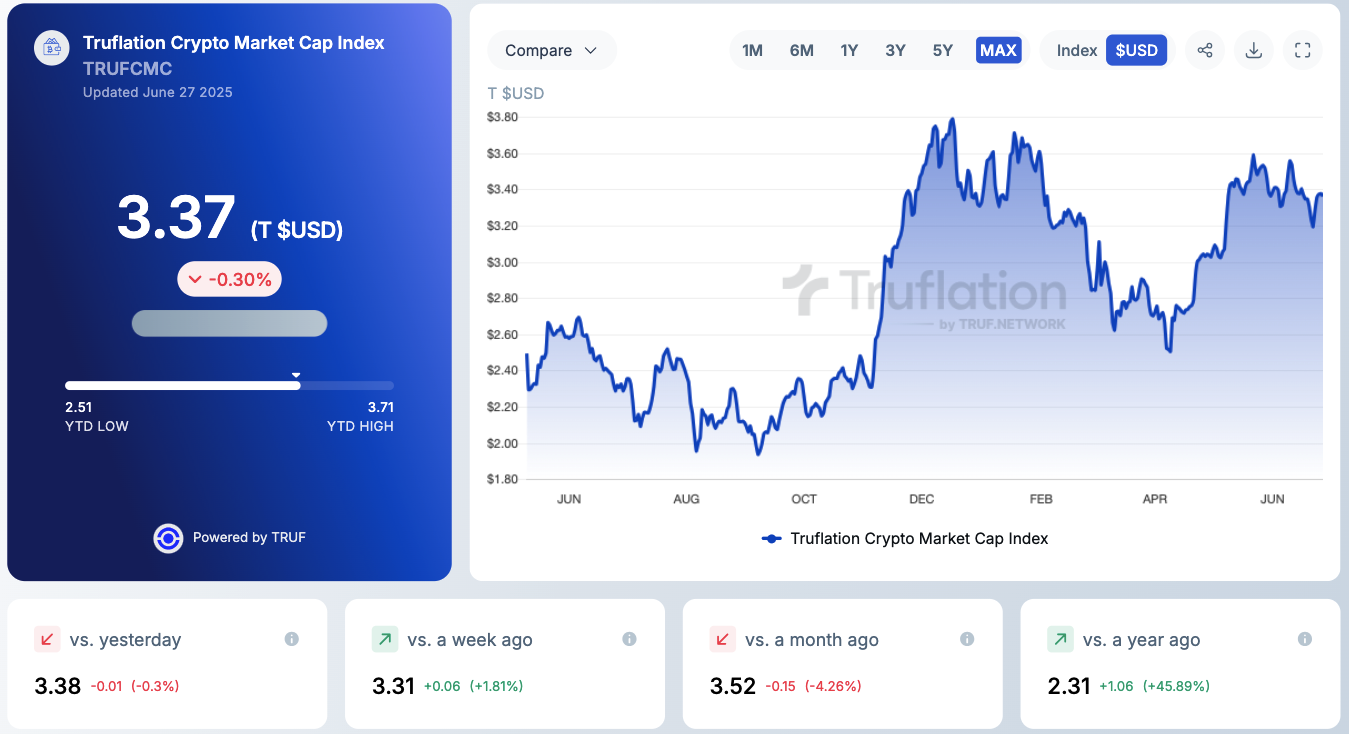

As of June 27, 2025, the TRUFCMC stands at $3,365,436,789,247.66.

The recent trend is increasing, with the current value notably above several key threshold levels, including the $3 trillion and $3.3 trillion marks, and approaching the higher resistance levels observed in previous months.

Despite being below the all-time high, the index remains well above its median and long-term averages, underscoring sustained upward momentum within its historical context.

Performance:

- Week-on-week: +1.81%

- Month-on-month: -4.26%

- Year-on-year: +45.89%

The Index has historical data from May 2024 and is released in USD price as well as an Index allowing it to be compared to other indices from the same day such as BTC, S&P 500, etc.

Why It Matters

The Pre-Eminent Price Benchmark

Finally, we have a trusted reference rate for the entire crypto market. One number. Cross-provider. Transparent. Real-time.

A Tool for Risk Managers & Builders

Use TRUFCMC to gauge market volatility and shift allocations accordingly.

Create crypto-native index funds, derivatives, or structured products using a single, consistent benchmark.

Integrate it directly into DeFi protocols and smart contracts—on-chain ready.

Made for the TRUF Economy

This isn’t just a Truflation product. It’s part of a broader vision powered by TRUF.NETWORK, the ecosystem where transparency and independence define how economic data is delivered, consumed, and trusted.

Clarity in a World of Noise

In today’s high-stakes, data-driven markets, a misinformed position is a costly one. With inflation running hot and interest in crypto surging, market participants need real-time tools grounded in truth, transparency, and tech.

The TRUFCMC delivers just that, leveraging Truflation’s commitment to decentralized data and TRUF.NETWORK’s infrastructure.

⚙️ Product Specs at a Glance

| Spec | Detail |

|---|---|

| Ticker | TRUFCMC |

| Update Frequency | Daily @ 23:59 UTC |

| Rebalance Frequency | Monthly |

| Providers | CoinGecko, CoinMarketCap, CryptoRank, CoinPaprika, CoinStats, Santiment |

| API Access | API Access (subscription required) |

| Tradable Soon on | Index.fun |

Who It’s For

- Macro Portfolio Managers tracking real-world + crypto macro trends

- Investment Advisors managing diversified portfolios

- Crypto Builders developing structured products and vaults

- Data Scientists & Analysts performing trend analysis

- Everyday Degens who just want to know the score

This is the index that speaks your language, not Wall Street’s.