Your Inflation Is Not My Inflation

Why Inflation Isn’t One Size Fits All — Your Reality Might Be Far From the Headlines.

Day 15 of 100 Days of TRUF

When the headlines scream “Inflation is at 3.2%,” what does that actually mean for you? If you’re a Software Engineer in San Fran, a stay-at-home parent in Mumbai, or a rideshare driver in Buenos Aires, that single number might paint a wildly inaccurate picture of your reality. Inflation, despite how we discuss it in policy circles and financial news, is deeply personal. It touches every corner of our lives - but it does so differently for each of us.

The U.S. Bureau of Labor Statistics, for example, is scheduled to release the Consumer Price Index (CPI) data for May 2025 on Wednesday, June 11, 2025, at 8:30 a.m. Eastern Time (2:30 p.m. Central European Summer Time). This release will provide insights into the inflation rate for the United States over the 12 months ending in May 2025.

Who cares? You should.

Why Inflation Hits Home

For most of us, inflation isn’t just an abstract economic metric. It’s the tightening feeling at the grocery store. It’s the delayed car repair. It’s the vacation that turns into a staycation.

That’s because inflation isn’t a universal experience. It’s not a law of physics, applied evenly across the globe. It’s a basket of prices - and the composition of that basket depends entirely on your lifestyle, location, and income.

So why does inflation matter at a personal level? Because if you don’t understand how your costs are rising, you might not realize how quickly your purchasing power is eroding. And without that awareness, it’s easy to fall into the trap of leaving your money idle, assuming things are okay - until they’re not.

Urban vs. Rural: Geography Is Destiny

Let’s start with a simple divide: city life versus country life.

Urban dwellers often feel inflation most acutely through rising rents, ride-share fees, and services like child care and food delivery. Meanwhile, rural residents might be more impacted by fuel prices, grocery costs (due to distribution logistics), and healthcare access.

When gas prices spike, it’s not just annoying - it’s a tax on mobility for rural dwellers. For someone who drives 30 miles to work every day, fuel inflation can quietly drain hundreds from a monthly budget. For a city resident taking the subway, it’s hardly a blip.

Renters vs. Homeowners: Shelter Costs Aren’t One-Size-Fits-All

Housing is one of the biggest variables in personal inflation. If you’re a renter, inflation can feel like a moving target - and landlords often pass rising costs directly to tenants. Meanwhile, homeowners with fixed-rate mortgages are shielded (at least partially), and in some cases even benefit from inflation, as asset prices like real estate rise.

Two households in the same zip code can experience drastically different inflation rates depending on whether they’re locked into a 2.5% mortgage or facing a 12-month lease renewal in a hot rental market.

Gig Workers vs. Salaried Employees: Insecurity vs. Illusion

Inflation also cuts differently depending on how you earn. Gig workers - delivery drivers, freelancers, creators - often face the brunt of rising costs with no accompanying increase in pay. If gas and food prices spike but your gigs don’t pay more, you’re effectively losing income.

Salaried workers may feel more stable, but that stability is fragile. A 3% annual raise sounds good until inflation is 6%. Without inflation-adjusted compensation, wage stagnation quietly eats into your lifestyle.

The gig economy promised freedom. But in an inflationary world, freedom without financial infrastructure can mean floating untethered - and sinking fast.

Real Divergence: What the CPI Ignores

The Consumer Price Index (CPI) is often treated as gospel. It’s the headline figure used by policymakers and central banks. But CPI is a national average. It flattens out the peaks and valleys of economic experience. It doesn’t tell you how your costs are changing - only how the average person’s might be.

Take these examples:

Rising Food Costs: A family that spends 30% of their income on food will feel inflation much more intensely than a single person who spends 10%, even if both see prices rise by the same percentage.

Deflation in Tech vs. Inflation in Services: In some sectors, prices are actually falling. A laptop may cost less than it did two years ago. But try getting a plumber on short notice. The cost of skilled services has soared. Depending on what you consume most, your personal inflation might be running hotter or colder than the official number.

Global Contrast: Even countries with similar CPI numbers can have radically different inflation realities. A 5% inflation rate in Switzerland might feel mild compared to 5% inflation in Argentina, depending on wage growth, currency volatility, and price controls.

Know Your Inflation

So what can you do?

First, stop assuming that the CPI is your personal inflation rate. Instead, calculate it for yourself using tools like Truflation’s Personal Inflation Calculator. This simple tool lets you plug in your real-world spending to see how your costs are evolving - not your neighbor’s, not Wall Street’s, and certainly not the government’s sanitized average.

Once you understand your personal inflation, you might be shocked into action. Maybe it’s time to move your cash out of zero-interest accounts. Maybe it’s time to rethink your investment strategy. Maybe it’s just time to acknowledge that your purchasing power isn’t as stable as you thought.

Don’t Let Your Money Sleep

When inflation is invisible or misrepresented, it’s easy to become complacent. That’s how savers become losers - not through bad decisions, but through inaction. If you leave your money sitting still while your real-world costs rise, you’re effectively taxing yourself.

Understanding your inflation is the first step to reclaiming control. It’s a signal to shift your behavior - to invest, to budget, to optimize - before inflation turns your future into a shadow of what you expected.

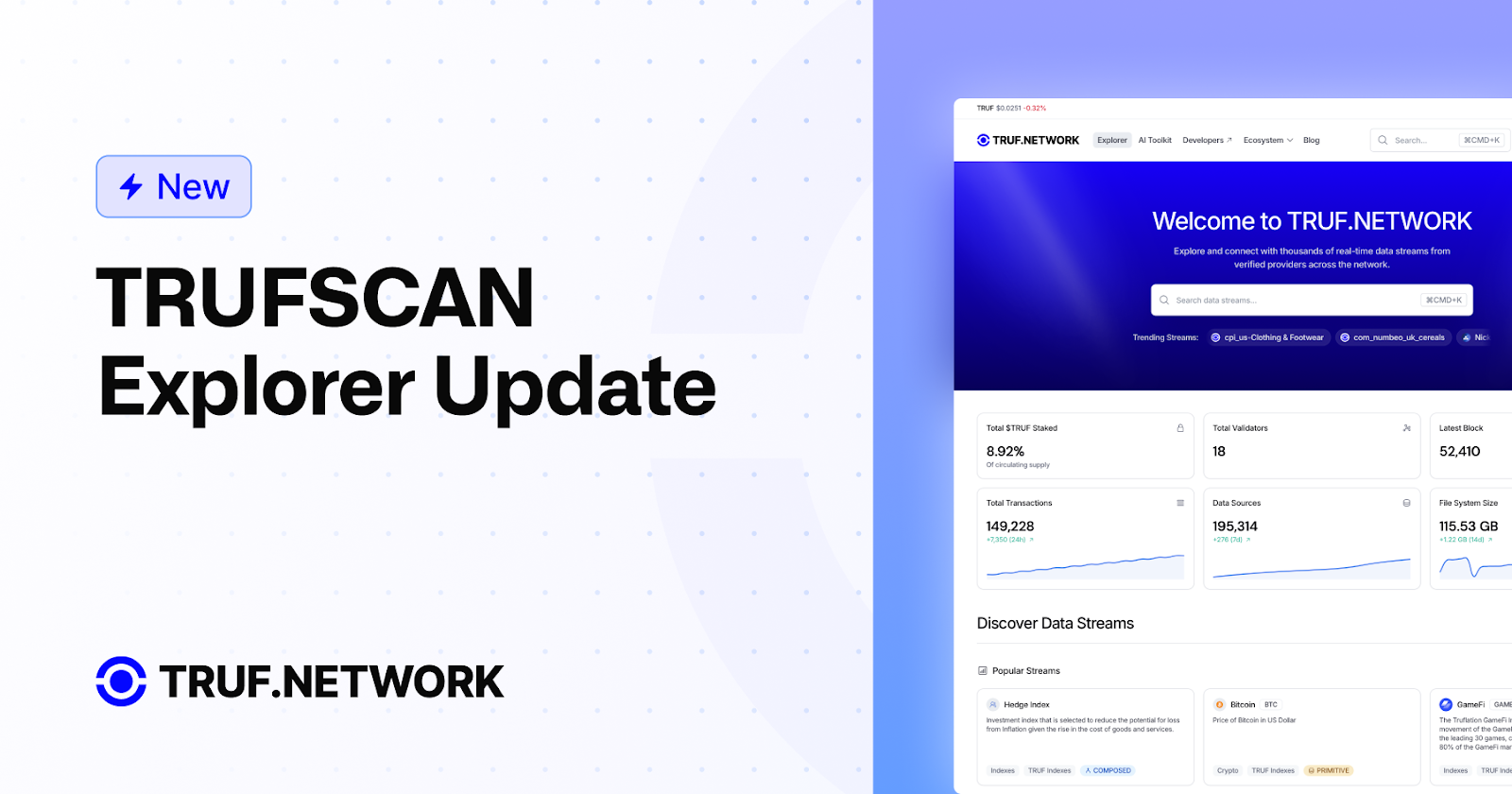

Why This Matters to TRUF.NETWORK

Truflation, the platform behind the personal inflation calculator, is built on TRUF.NETWORK - a decentralized oracle infrastructure delivering real-time, transparent economic data. It’s part of a movement to replace broken economic signals with real, trustworthy, verifiable information.

Because in a world where trust is the scarcest asset, truthful data is power.