Understanding TRUF.NETWORK

TRUF.NETWORK is building a decentralized, trustless infrastructure for public economic data—open, auditable, and real-time.

You’ve probably already heard about some projects using the TRUF.NETWORK, and noticed they’re bringing major innovation to their respective sectors.

But do you know what powers those projects?

TRUF.NETWORK provides the decentralized economic data infrastructure that Web3 projects need.

It’s the foundation and refinery of reliable data. Powered by the TRUF token, the ecosystem connects developers and users.

The Current Problem: Centralized Systems and the Public Data Trust Crisis

The global economy still relies heavily on centralized data infrastructure. Key indicators like inflation, GDP growth, unemployment, and consumer price indexes are typically produced by governments and regulatory agencies.

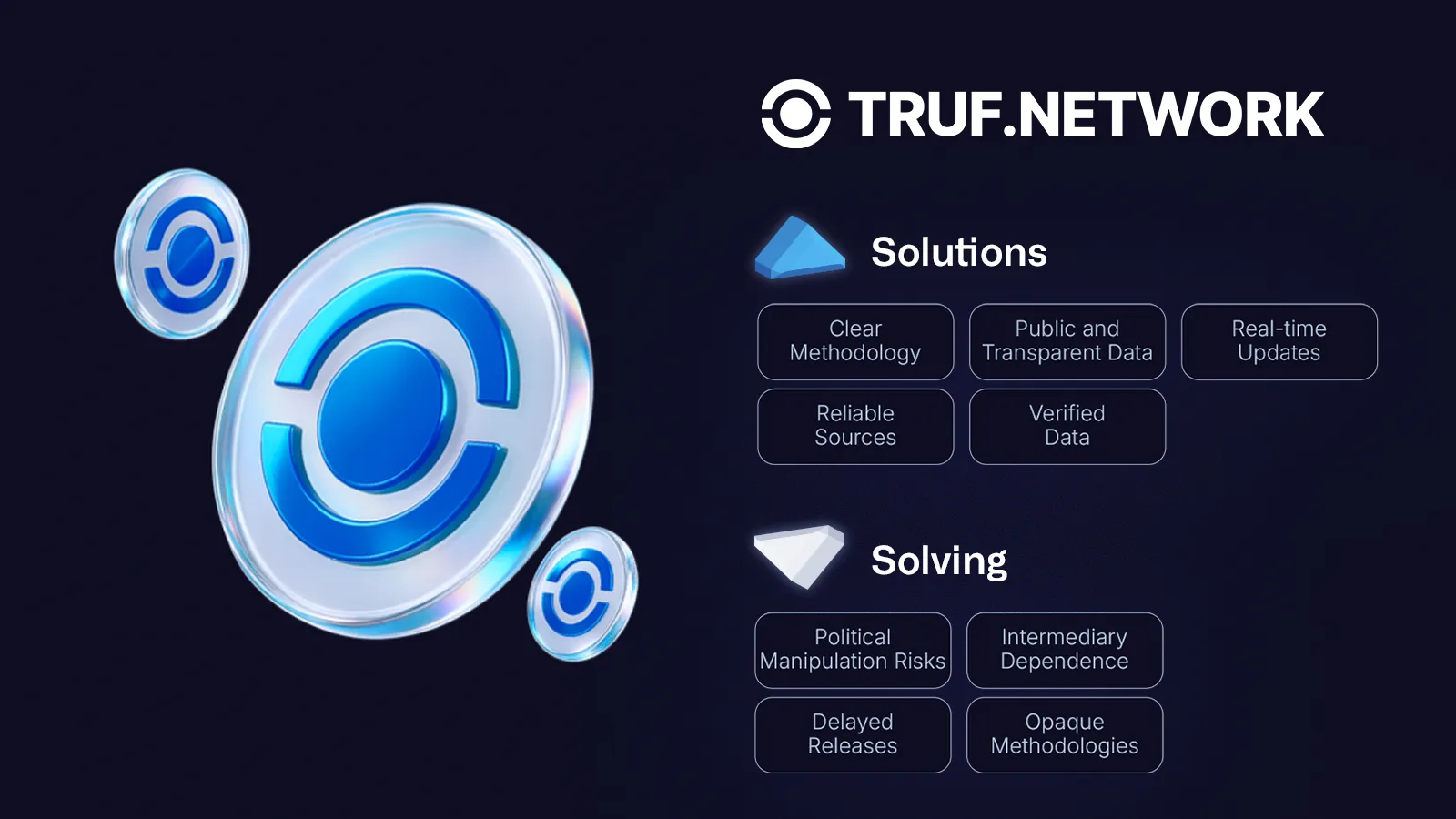

In recent years, this structure has faced increasing criticism:

- Delayed releases: Many macroeconomic indicators are published weeks or even months after the actual period.

- Opaque methodologies: Calculation formulas, seasonal adjustments, and weightings are often unclear or unavailable to the public.

- Political manipulation risks: In election seasons or fiscal stress, there’s an incentive to tweak numbers to support preferred narratives.

- Intermediary dependence: Most data reaches the market through third parties like agencies or financial terminals.

This creates hidden risk for traditional investors. How can you trust strategies built on incomplete, outdated, or manipulable data?

That’s where TRUF.NETWORK steps in.

The Solution: Blockchain and TRUF.NETWORK

TRUF.NETWORK is a decentralized infrastructure for publishing and validating economic data.

The goal is to fix a systemic flaw: today, vital data like inflation, prices, wages, and cost-of-living indexes are produced in centralized, often opaque, and delay-prone ways.

This new approach uses blockchain to make data public, immutable, and auditable from the source, without relying on governments, banks, or statistical agencies.

In practice, it works like this:

- Economic data is gathered from multiple trusted sources like marketplaces, APIs, sensors, or public records.

- That data is verified by independent network participants (validators) who stake tokens as a guarantee of their honesty.

- Once verified, the data is published on-chain, open for anyone to access, use, and audit.

- These datasets then fuel real-time financial applications: stablecoins, indexes, funds, insurance systems, and more.

TRUF.NETWORK is building a public, decentralized, transparent, and resilient economic data system.

How It Works: Key Technologies

The network is built on proven Web3 components, including:

- Oracles (like Chainlink) – These bring real-world data securely and reliably onto the blockchain.

- Custom SDKs and APIs – Enabling integration with apps, DeFi protocols, institutional platforms, and more.

- Staking-based validation – Validators must stake TRUF tokens to gain the right to publish or verify data.

This creates an ecosystem economically incentivized to seek truth.

A system where data integrity is protected not by regulators, but by a decentralized system with cryptographic and financial incentives.

The Role of the TRUF Token

The TRUF token is the native asset for securing and governing the network.

Its main functions:

- Staking for data validation: Network participants can stake their tokens to become validators, earning rewards for accurate data publication.

- Slashing mechanism: Malicious or inaccurate validators are penalized by losing part of their staked tokens, reinforcing data accuracy.

- Governance participation: Token holders help decide the network’s direction, including which data types to prioritize, which partnerships to pursue, and more.

This creates a truth-incentivized economy, where honesty is rewarded and manipulation is costly—a solid foundation for restoring trust in public data.

It’s also a way for users to actively participate in the network’s evolution, via governance and utility.

Use Cases: Who Is Using the TRUF.NETWORK

Unlike many emerging Web3 infrastructures still in testing, TRUF.NETWORK is live and in production, powering real financial protocols that share a common vision:

Replace subjective trust in institutions with objective, verifiable, real-time data.

Use cases range from inflation indexing to stablecoins and quant-driven investment strategies. Let’s look at some examples:

Truflation: Unfiltered Inflation

Possibly the most iconic use case of TRUF.NETWORK so far. An alternative inflation index to the official US CPI, but with daily updates, open methodology, and decentralized validation.

- Draws from over 30 million real-time data points, including marketplaces, price APIs, and consumer networks.

- Covers various cost-of-living categories: housing, transport, food, healthcare, education, and more.

- Relies on TRUF.NETWORK to record and verify updates, ensuring absolute transparency.

It’s being adopted by fund managers, independent analysts, and economic content creators as a more objective alternative to government stats.

Index.fun: Decentralized Indexes for a New Era

A platform for creating and tracking alternative financial indexes, like ETFs, but built for on-chain finance.

- Uses on-chain economic data from TRUF.NETWORK (inflation, unemployment, average costs) to build macro-themed indexes.

- Enables more responsive portfolio construction, without relying on intermediaries or slow-moving institutions.

Nuon.fi: Safe and Easy Access to DeFi Yields for Inflation Protection

Nuon is a yield-bearing stablecoin backed by a portfolio of yield-bearing DeFi assets and tokenized RWAs. The goal: to protect users from inflation that’s eroding the purchasing power of the US dollar and traditional stablecoins.

Nuon also democratizes access to DeFi yields by providing the simplest user experience and distributing the yields directly to users’ wallets without the need for staking or bonding periods.

Nuon uses Truflation’s high-frequency inflation feed powered by TRUF.NETWORK and secured by the TRUF token to calculate and secure the yield distributions equal to the Truflation CPI rate.

The yield simply appears daily in users’ wallets in the form of extra Nuons equal to current inflation and immediately available for sale or compounding.

Nuon is also creating institutional-grade security with economic safety measures built into the protocol, including the 3 layers of insurance for the Nuon stablecoin holders, lightweight governance, and decentralized portfolio allocations into curated, price-stable, yield-bearing assets.

Why It Matters for Traditional Finance Observers

Distrust in institutions is real, just remember:

- The LIBOR manipulation scandals

- The backlash over changes to the US CPI

- The collapse in trust toward rating agencies post-2008

TRUF.NETWORK offers a real alternative, an economic data infrastructure:

- Immune to censorship

- Transparent by design

- Incentivized to reflect reality

It doesn’t aim to replace traditional systems overnight, but the future is being built—a new baseline for confidence in a world where truth often competes with political agendas.

For institutional investors, fund managers, and economic analysts, TRUF.NETWORK is a strategic tool for cutting through noise.

Final Thoughts

TRUF.NETWORK isn’t just another blockchain project.

It’s a new paradigm for how we collect, validate, and use economic data.

Rather than trusting central institutions, we now have a system where veracity is economically incentivized, mathematically auditable, and technically accessible.

The TRUF token is your key to participation: earn, vote, and engage.

In a world where trust has become scarce, TRUF.NETWORK emerges as a priceless asset.

Join the movement. Be part of the shift.