Asia: The Frontier Driving FinTech's Revolution

Why Asia's Bold Fintech Moves Are Reshaping Global Finance - Key Insights from Stefan Rust & Ben Quinlan

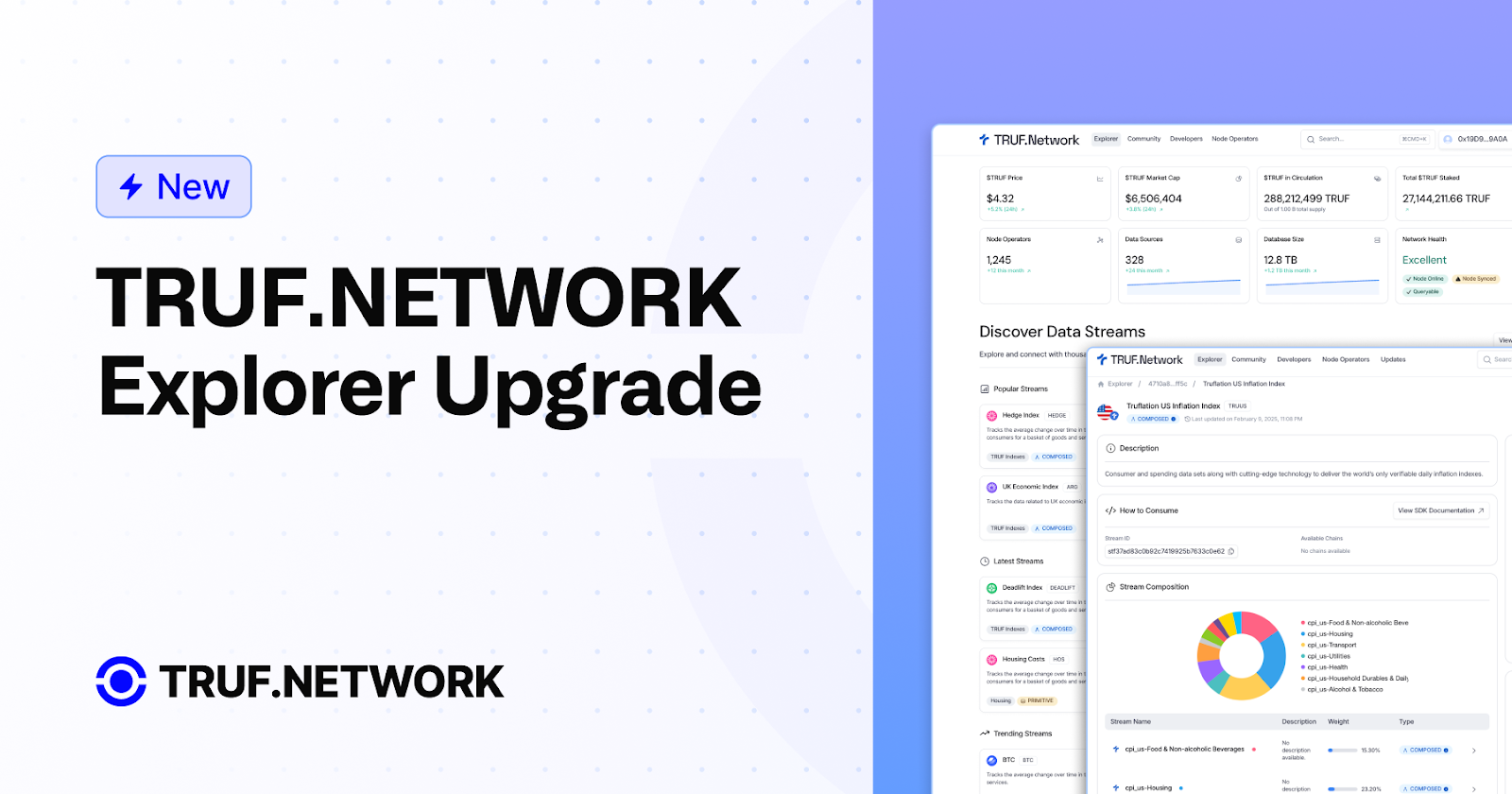

The financial world is undergoing a seismic shift, and Asia is at the epicentre of this transformation. In a recent episode of the SuperExcited podcast, Stefan Rust (CEO of Laguna Labs and builder of TRUF.NETWORK) sat down with Ben Quinlan (CEO of Quinlan & Associates) to explore how blockchain, stablecoins, and fintech innovation are reshaping the financial landscape.

For TRUF.Natives—builders, innovators, and those navigating the decentralised future—this conversation offers valuable insights into the challenges and opportunities driving fintech evolution in Asia.

Key Takeaways for TRUF.Natives

1. The Role of Blockchain in Financial Transformation

Stefan and Ben discuss how blockchain technology is disrupting traditional finance by enabling faster settlements, reducing costs, and increasing transparency. Stablecoins, in particular, are emerging as a bridge between Web2 and Web3 economies. However, adoption remains slow—only 30,000 merchants globally currently accept crypto payments.

2. Why Asia’s FinTech Ecosystem Thrives

- Asia’s unique financial culture plays a critical role in its fintech dominance: A risk-taking mindset drives speculative investments and rapid adoption of new technologies.

- The region’s underbanked population has catalysed the rise of virtual banks and buy-now-pay-later solutions.

- Unlike Western markets, Asian consumers demand high returns quickly—creating fertile ground for crypto and decentralised finance (DeFi).

3. Insurance: A Sector Ripe for Disruption

Ben highlights that Hong Kong’s insurance market is heavily intermediated, with commissions eating up 80–90% of first-year premiums for savings products. Blockchain could revolutionise this sector by enabling direct-to-consumer models, reducing costs, and improving transparency—but innovation has been slow to take hold.

4. Old Money vs New Money

Traditional financial institutions are struggling to keep up with the pace of disruption due to short-term KPIs and risk-averse cultures. Meanwhile, new players in DeFi and blockchain are embracing decentralisation and community-driven innovation at lightning speed.

5. The Future of Stablecoins

Regulated stablecoins could transform payments by offering instant settlement, low fees, and regulatory legitimacy. However, to gain traction, they must overcome hurdles like merchant acceptance and regulatory clarity.

Dive Deeper

For a full exploration of these topics—and more insights into why Asia is leading the charge in fintech innovation—watch the full podcast video here: